Remuneration Structure and Elements

a) Overview

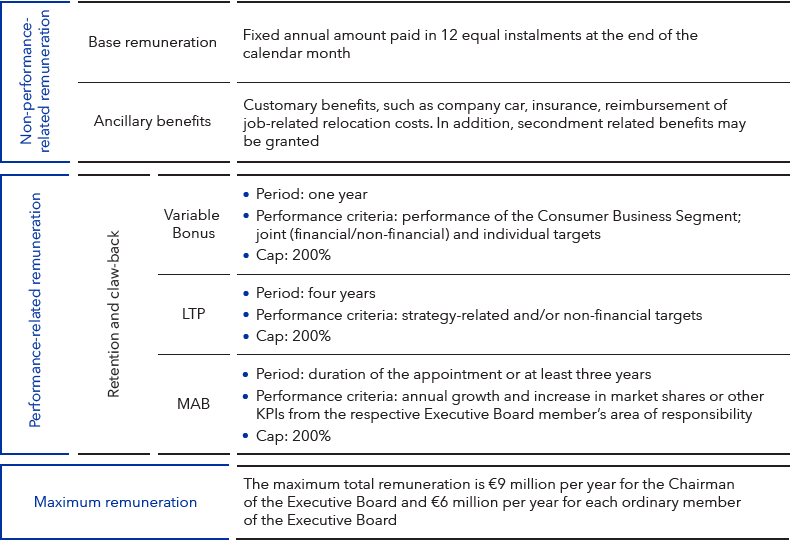

The total remuneration payable to the members of the Executive Board is composed of fixed and variable elements. The fixed remuneration, which is not tied to performance, comprises the base remuneration plus ancillary benefits. The variable remuneration is composed of a short-term variable bonus with annual targets (Variable Bonus) and a long-term variable bonus (LTP). It may also contain a multi-annual bonus (MAB) that is tied primarily to the targets defined for the area of responsibility of that member of the Executive Board. In addition, the members of the Executive Board may be offered a reappointment bonus (which may also be tied to performance).

The serving members of the Executive Board do not receive any pension commitments from the company. Executive Board members can decide in individual cases to convert their LTP into a defined contribution benefit commitment for which a reinsurance policy can be concluded.

Remuneration Components

As a rule, the relative share of the base remuneration, on the one hand, and the short-term and long-term variable remuneration, on the other hand, break down as follows (including regular benefits but excluding any secondment-related benefits and reappointment bonuses):

Relative Shares of the Remuneration Components

In this description of the relative shares, long-term variable remuneration components (MAB and LTP) are included with an annual target value on a prorated basis, notwithstanding the fact that they are not due for payment until the end of the period. If a member of the Executive Board is granted a reappointment bonus, this is generally up to 50% of the annual target total remuneration at the beginning of the appointment period. The secondment-related benefits may equal an amount of up to 100% of the base remuneration depending on the location (see c) below for a breakdown of ancillary benefits). The relative shares accounted for by the other remuneration components are modified correspondingly in these cases.

The variable remuneration is predominantly measured over a multi-year period. In addition, the share of variable remuneration from long-term targets exceeds the share from short-term targets.

The remuneration of the individual members of the Executive Board in 2024, including the relative shares of the remuneration components granted and owed (within the meaning of § 162 (1) sentence 2 no. 1 AktG) is reported in the “Remuneration of the individual Executive Board members in 2024” section.

b) Base Remuneration

The base remuneration is a fixed annual amount paid in 12 equal installments at the end of each calendar month. If the service agreement begins or ends part way through a financial year, the base remuneration for that financial year is paid pro rata.

Together with the other remuneration components, the base remuneration forms the basis for recruiting and retaining the highly qualified members required by the Executive Board to develop and implement the business strategy. The remuneration should reflect both the duties and the performance of the individual Executive Board members and their skills and experience.

c) Ancillary Benefits

Each Executive Board member receives customary non-cash remuneration components and other ancillary benefits. The regular benefits may include:

- Provision of a company car, which may also be used for private purposes. In accordance with the Group’s “Green Car Policy,” the emissions produced by the company car must not exceed a certain carbon threshold. In lieu of a company car, a monthly “cash for car” allowance may also be granted

- Customary insurance cover, including contributions to health and accident insurance, as well as to any invalidity and surviving dependents policies

- Reimbursement of job-related relocation costs

- Allowance for school expenses

If, at the request of the company, a member of the Executive Board relocates their place of work or residence or does not maintain them at the headquarters of the company, other benefits may be granted. Such secondment-related benefits may particularly include:

- Foreign-secondment allowance to cover the cost of accommodation at the place of residence

- Cost of flights for the member of the Executive Board and their family to and from the place of residence

- Further health insurance expenses

d) Reappointment

In individual cases, the Supervisory Board may agree on a bonus payable in the event of reappointment. As a rule, this reappointment bonus is due upon the reappointment taking effect (“reappointment bonus”).

The Supervisory Board may at its own due discretion determine the structure of the reappointment bonus, in particular as a performance-related bonus, to which the performance criteria defined for the Variable Bonus (see e) below) or the MAB (see f)) apply.

e) Variable Bonus

The members of the Executive Board receive for each financial year a Variable Bonus tied to the performance of the Consumer Business Segment, which is paid out after a one-year measurement period following the Annual General Meeting of the year following the financial year in question.

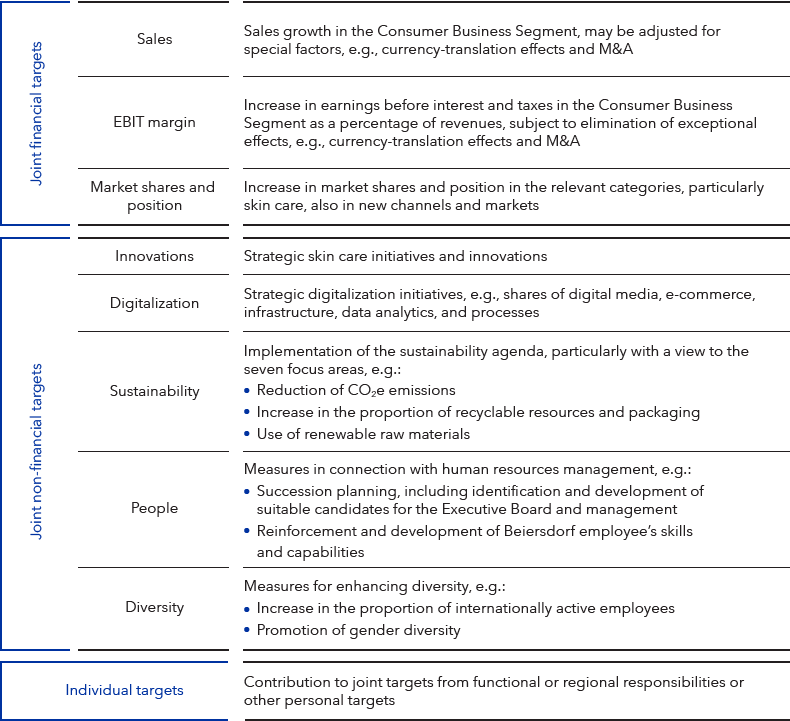

The Variable Bonus is composed of joint and individual performance criteria that are tied to the company’s financial and non-financial performance as well as its strategic and operational development. The joint targets are given a weighting of 70 – 90% and the individual targets a weighting of 10 – 30%.

Variable Bonus

The Supervisory Board determines the selection and weighting of the individual performance criteria at the recommendation of the Presiding Committee for the new financial year. With respect to the total Variable Bonus, the individual performance criteria for the joint targets generally have a weighting of 10 – 40% and the individual targets a weighting of 5 – 20%.

In accordance with the remuneration system, the following performance criteria may be used for the Variable Bonus (at the discretion of the Supervisory Board):

The performance criteria underlying the Variable Bonus create an incentive for the Executive Board to increase the company’s enterprise value on a sustained and long-term basis in line with the business strategy. In particular, sales are to be increased by opening up new growth markets and areas of business, while profitability is to be improved by means of simultaneous investments in innovations. Market shares are to be widened and market positions strengthened by reinforcing the global brands and improving consumer proximity as well as through new digital channels and technologies. The performance criteria defined in the sustainability agenda and those related to diversity also reflect – in line with the Core Values underlying the strategy – the responsibility that the Executive Board has for creating long-term value for people, the environment, and society.

As a general rule, the targets defined for the performance criteria are based on the applicable annual planning. Similarly, measurable criteria are defined for the non-financial targets as far as possible. Depending on the individual case, these may be derived from the annual planning, strategic projects, or other activities. The achievement of non-financial targets is determined by comparing actual with target achievement.

On this basis, the Supervisory Board defines percentage target-achievement levels for the components of the Variable Bonus after the end of the financial year. The following target-achievement levels apply:

- The applicable components are omitted if target achievement is less than 70%.

- 50% of the target amount defined for the component in question is granted for target achievement of 70%.

- 80% of the target amount defined for the component in question is granted for target achievement of 80%.

- 200% of the target amount defined for the component in question is granted for target achievement of 200%. A cap is applied to target achievement of above 200%.

- The intermediate values are interpolated on a linear basis.

Target Achievement Levels – Variable Bonus

Subsequently, the total target achievement for and the amount of the Variable Bonus is calculated on the basis of the target achievement for the individual components.

For the 2024 Variable Bonus, the Supervisory Board set the joint and individual performance targets shown in the table below at the end of 2023 and, on February 3, 2025, determined the level of target achievement (also shown below) and resulting payment amount. In view of the end of the measurement period on December 31, 2024, the 2024 Variable Bonus was “granted” to the Executive Board members in the financial year 2024, even though it will not be paid out until after the 2025 Annual General Meeting.

Variable Bonus 2024

Performance criteria |

|

Target level |

|

Actuals 2024 |

|

Weighting |

|

Target achievement |

|||

|---|---|---|---|---|---|---|---|---|---|---|---|

Net sales growth Consumer |

|

6% net sales growth |

|

7.1% |

|

20% |

|

143% |

|||

EBIT increase Consumer |

|

Increase of earnings before interest and tax (EBIT) without special factors as % of sales to 13.1% |

|

14.2% |

|

10% |

|

180% |

|||

Skin Care in-market performance |

|

Outperforming relevant skin care market: increase in sales above market in 2024 (index of 101.3) |

|

Index 100 |

|

30% |

|

50% |

|||

NIVEA and Derma innovation |

|

Share of target net sales of most important innovation projects of 14.5% in 2024 |

|

17.5% |

|

5% |

|

180% |

|||

Digital transformation |

|

Disproportionately high growth of e-commerce: increase in e-commerce net sales by 18% (vs. 2023) |

|

20.8% |

|

5% |

|

150% |

|||

Target achievement for joint targets |

|

|

|

|

|

111.6%1 |

|||||

|

|||||||||||

|

|

Performance criteria |

|

Weighting |

|

Target achievement |

|---|---|---|---|---|---|---|

Vincent Warnery |

|

CEO: Development of Skin Care business; drive digitalization; lead sustainability; future fit organization |

|

30% |

|

135% |

Oswald Barckhahn |

|

Europe/North America: Cosmetics and Derma integration; digital operating model; development of Coppertone business; people and culture (including gender diversity) |

|

30% |

|

100.8% |

Astrid Hermann |

|

Finance: Digitalization and process acceleration; elevate venture capital; continue transformation of finance organization |

|

30% |

|

125% |

Nicola D. Lafrentz |

|

HR: Talent development with focus on leadership excellence; continued focus on diversity and inclusion (including disability inclusion); further digitalization of HR |

|

30% |

|

125% |

Grita Loebsack |

|

NIVEA: Face Care strategic development; digital acceleration; leadership development |

|

30% |

|

112.5% |

Ramon A. Mirt |

|

Emerging Markets: Cosmetics and Derma integration; new markets; development of organization (including diversity) |

|

30% |

|

143% |

Patrick Rasquinet |

|

Luxury: Development of La Prairie and Chantecaille business; leadership development |

|

30% |

|

50% |

|

|

Target remuneration (in € thousand) |

|

Overall target achievement |

|

Bonus amount |

|---|---|---|---|---|---|---|

Vincent Warnery |

|

900 |

|

118.6% |

|

1,067 |

Oswald Barckhahn |

|

200 |

|

108.4% |

|

217 |

Astrid Hermann |

|

200 |

|

115.6% |

|

231 |

Nicola D. Lafrentz |

|

200 |

|

115.6% |

|

231 |

Grita Loebsack |

|

200 |

|

111.9% |

|

224 |

Ramon A. Mirt |

|

200 |

|

121.0% |

|

242 |

Patrick Rasquinet |

|

200 |

|

83.5% |

|

167 |

f) Multi-Annual Bonus (MAB)

Under the remuneration system applicable in 2024, the long-term variable remuneration for the members of the Executive Board may in individual cases additionally include a multi-annual bonus (“MAB”). The MAB particularly has the strategic purpose of strengthening Beiersdorf in regional growth markets or specific business areas.

The performance criteria for the MAB are derived from the targets defined for the areas of responsibility assigned to the members of the Executive Board. In particular, target achievement may be measured on the basis of growth according to annual or multi-annual corporate planning and by reference to the growth in market shares in the applicable region or business area during the appointment of the relevant member of the Executive Board or over a period of at least three years.

Multi-Annual Bonus

Of the serving Executive Board members, an MAB was allocated only to Ramon A. Mirt in 2024 (target amount: €500 thousand p.a.) on a prorated basis for his activities in Group companies until June 30, 2024, the date of his reappointment. The MAB is calculated based on the average annual growth rate in accordance with corporate planning in the regions for which Ramon A. Mirt is responsible and on the increase in market shares, both throughout a measurement period from January 1, 2019, to December 31, 2024. Following the end of this period, the Supervisory Board determined the level of target achievement and resulting payment amount.

Allocation |

|

Target |

|

Target (= 100% target achievement) |

|

Actuals |

|

Target achieve- |

|

Overall target achievement |

|

Target amount (in € thousand) |

|

Bonus amount |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Ramon A. Mirt Mar. 2019 to Jun. 2024 |

|

Sales |

|

Average annual increase in sales of 7.2% in the “Emerging Markets” region during measurement period from 2019 until 2024 (adjusted for special factors) |

|

11% p. a. |

|

120% (Cap) |

|

120% (Cap) |

|

2,667 |

|

3,200 |

|

Value above market (as multiplier) |

|

Outperforming relevant skin care market: increase in sales above market (average index of 100.5 p.a.) |

|

Index 101.6 |

|

125% |

|

|

|

g) Long-Term Bonus (LTP)

LTP 2021 – 2024

Executive Board members receive a multi-annual bonus measured on the basis of the targets for the achievement of strategic criteria after the expiry of a four-year bonus period from 2021 through 2024 (LTP 2021 – 2024). For Executive Board members appointed during the current LTP 2021 – 2024 bonus period, a prorated bonus period up to the end of 2024 applies.

Long-Term Bonus

The LTP 2021 – 2024 makes a material contribution to advancing the company’s C.A.R.E.+ strategy relevant in that period by giving the Executive Board an incentive for securing sustainable and profitable growth particularly by strengthening the focus on skin care, sustainability, digitalization, opening up new growth markets and business areas, innovations, and human resource development. Joint targets for all members of the Executive Board apply to the LTP 2021 – 2024 and are tied to the company’s strategic development. They can be weighted individually depending on the duties involved. For this purpose, the Supervisory Board defined measurable non-financial or financial criteria, which are primarily derived from the implementation of the C.A.R.E.+ strategy and the multi-annual planning required to be submitted to the Supervisory Board for approval.

After the expiry of the bonus period, the Supervisory Board defines the percentage target achievement levels between 0 and 200% for the strategic targets of the LTP 2021 – 2024. At or above an overall target achievement of 90%, target achievement of the aforementioned strategic targets is weighted with the target achievement for the performance metrics (if target achievement ≥ 100%) from the multi-year planning adopted in 2021. Nominal sales growth exceeding the market (with an EBIT gatekeeper of +/–10% deviation from plan) accounts for half of these performance criteria. Outperformance of the relevant skin care market (based on market shares and measured as net value added, excluding market growth and portfolio mix effects) in the Consumer categories accounts for the other half.

On the recommendation of its Presiding Committee, the Supervisory Board set the performance criteria and weightings in the table below for the LTP 2021 – 2024 at the beginning of the bonus period. Following expiry of the bonus period at the end of 2024, the Supervisory Board determined the level of target achievement (also shown below) and resulting bonus payment for the LTP 2021 – 2024 at the recommendation of its Presiding Committee on February 3, 2025. This amount will be due for payment following the 2025 Annual General Meeting and was therefore “granted and owed” to the serving Executive Board members in 2024 within the meaning of § 162(1) AktG.

Strategic targets |

|

Target level (100% target achievement) |

|

Actuals |

|

Weighting |

|

Target achievement |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Digital transformation |

|

Increase in e-commerce sales by 95% (vs. 2021) up to 2023 |

|

85% |

|

10% |

|

20% |

|

72% |

|

136% |

|||

|

Successful go-live of S4/HANA |

|

S4/HANA go-live well ahead of plan |

|

5% |

|

|

200% |

|

||||||

|

Increase in digital 1-on-1 consumer connections by 28% |

|

117% |

|

5% |

|

|

200% |

|

||||||

Win with Skin Care |

|

Implementation of a new innovation management process |

|

Innovation management process implemented above plan |

|

10% |

|

20% |

|

120% |

|

158% |

|||

|

Increase in innovation share to 10% (of net sales) |

|

18% |

|

10% |

|

|

195% |

|

||||||

Opening up growth markets and areas of business |

|

Implementation of 9 strategic initiatives to accelerate sales growth in the USA, China and the Emerging Markets through enlarged presence |

|

8/9 strategic initiatives fully implemented; sales targets in particular in China behind plan |

|

|

|

20 % |

|

|

|

53 % |

|||

Sustainability |

|

Reduction of global scope 1, 2 and 3 emissions by 20% (vs. 2018) |

|

-23% |

|

5% |

|

20% |

|

100% |

|

99% |

|||

|

Increase in share of recycled materials in plastic packaging by 20% by 2024 |

|

22% |

|

5% |

|

|

100% |

|

||||||

|

Transformation of the “Big4” NIVEA ranges focusing on sustainable formulations and packaging. |

|

3 ranges successfully transformed (100%); |

|

10% |

|

|

97.5% |

|

||||||

Diversity and employee development |

|

Increase in proportion of women at management levels MG 1–4 to 45% |

|

51% |

|

10% |

|

20% |

|

100% |

|

100% |

|||

|

Succession planning for MG 1–4, including increase of internal and international promotions to 75% |

|

77% |

|

5% |

|

|

100% |

|

||||||

|

Diversity & Inclusion targets |

|

Achieved as planned |

|

5% |

|

|

100% |

|

||||||

Target achievement strategic targets |

|

108.9% |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Performance metrics (applicable as multiplier if strategic targets ≥ 90%) |

|||||||||||||||

Value above market |

|

Outperformance of relevant skincare market (market share, measured as net value creation, adjusted for portfolio mix effects): Index of 101.0 |

|

Index 100,4 |

|

50% |

|

97% |

|||||||

Net Sales |

|

Net sales growth (nominal and adjusted for inflation) from 2021 to 2024 (gatekeeper: EBIT target p.a. of the annual business plan +/- 10%) in the amount of 4% p.a. |

|

5.5% |

|

50% |

|

150% |

|||||||

Target achievement performance metrics |

|

|

|

|

|

|

|

123.6% |

|||||||

Overall target achievement |

|

|

|

|

|

|

|

148,9 %1 |

|||||||

|

|||||||||||||||

|

|

Target remuneration LTP 2021–2024 (in € thousand) |

|

Overall target achievement |

|

Bonus amount |

||

|---|---|---|---|---|---|---|---|---|

|

|

p.a. |

|

entire term |

|

|

|

|

Vincent Warnery |

|

2,000 |

|

7,333 |

|

148.9% |

|

10,920 |

Oswald Barckhahn |

|

1,550 |

|

4,960 |

|

148.9% |

|

7,386 |

Astrid Hermann |

|

753 |

|

3,010 |

|

148.9% |

|

4,585 |

Nicola D. Lafrentz |

|

450 |

|

1,200 |

|

148.9% |

|

1,852 |

Grita Loebsack |

|

1,300 |

|

3,900 |

|

148.9% |

|

5,807 |

Ramon A. Mirt |

|

713 |

|

2,850 |

|

148.9% |

|

4,244 |

Patrick Rasquinet |

|

700 |

|

2,450 |

|

148.9% |

|

3,648 |

LTP Enterprise Value Component under the old remuneration system

As per their contracts under the remuneration system in place before 2021, the serving Executive Board members appointed prior to 2021 received a share in the increase in enterprise value for the Consumer Business Segment in the form of a multi-annual bonus (LTP Enterprise Value Component), which was based on a mathematical formula drawn from the annual financial statements at the beginning and end of their terms of office, provided it had not already been settled. The measurement period for the LTP Enterprise Value Component continued for one Executive Board member only in 2024, Ramon A. Mirt. He was offered this for the period 2019 and 2020, prior to introduction of the LTP 2021 – 2024.

Under the LTP Enterprise Value Component, Executive Board members were allocated a notional share of the enterprise value (Base Virtual Units, BVU) at the start of their period of appointment or reappointment. The Executive Board member will be paid their share of the percentage increase in the LTP Enterprise Value Component once their period of appointment or reappointment has ended and following, where applicable, an additional vesting period (“bonus period”).

The increase in enterprise value corresponds to the percentage share of the Executive Board member’s allocated Enterprise Value Component that will be paid to them. The increase in enterprise value is calculated from the increase in sales from the beginning to the end of the bonus period, unless EBIT deviates by more than 10% from plan. As with the Variable Bonus, sales are adjusted for special factors. If applicable, EBIT is adjusted for, among other things, any deviations from the plan for marketing expenses as well as expenses for research and development compared with the start of the bonus period. As a rule, the LTP Enterprise Value Component is limited to a maximum amount (200% cap, corresponding to around 10% p.a.).

In 2024, the measurement period of Ramon A. Mirt’s LTP Enterprise Value Component expired. The table below shows how this LTP Enterprise Value Component and the associated bonus were determined by the Supervisory Board.

Allocation |

|

Target |

|

Target remuneration over entire term |

|

Actual |

|

Target achieve- |

|

Bonus amount |

|---|---|---|---|---|---|---|---|---|---|---|

Ramon A. Mirt Mar. 2019 to Dec. 2020 |

|

Average annual increase in sales of 5% p.a. during measurement period from 2019 to 2024 |

|

Virtual Units: 1,100 |

|

Sales increase: 5% p.a. |

|

100% |

|

1,100 |

Capping of the variable remuneration and maximum remuneration

The amount of all variable remuneration elements is capped at 200% of the applicable individual target amount. The amount of the maximum total remuneration is determined on the basis of this relative cap taking into account all fixed and other remuneration components that may be granted to a member of the Executive Board depending on the individual case.

The maximum remuneration is €9 million per year for the Chairman of the Executive Board and €6 million per year for each ordinary member of the Executive Board. This maximum remuneration contains the amounts of the long-term variable remuneration (MAB and LTP) with an annual maximum value (200%) on a prorated basis, notwithstanding the fact that they are not due for payment until the end of the period. In principle, it is not possible to report on adherence to maximum remuneration within the meaning of § 162 (1) sentence 2 no. 7 AktG until after the long-term variable remuneration has been paid out. Therefore, the remuneration granted and owed in 2024 to the individual Executive Board members upon calculation of the LTP 2021 – 2024 at the end of the reporting year is compared with the maximum remuneration (see tables in the following section “Remuneration of the individual Executive Board members in 2024”).

Adjustments as well as retention and clawback

The Supervisory Board has the option to raise or lower at its own due discretion the variable remuneration by up to 20%, for example to appropriately take account of exceptional circumstances.

Under the applicable remuneration system, variable remuneration components that have already been determined or paid may be retained or claimed back by the Supervisory Board if the basis for calculating the original target achievement, particularly the applicable consolidated financial statements, subsequently proves to be materially incorrect due to new facts or evidence (“clawback”). However, this possibility is barred no later than three years after payment. This does not prejudice any other remedies that the company may have to recover damages from the member of the Executive Board, particularly under § 93 (2) AktG. The Supervisory Board did not make use of this possibility in 2024.

Rules in relation to termination of Executive Board members’ duties

In the event of the premature termination of the office or activities of a member of the Executive Board for reasons beyond that member’s control, the Executive Board service agreements provide for a cap on the termination benefits or other payments of twice the value of the base remuneration and twice the value of the annual Variable Bonus or a cap equaling the total target remuneration for the remaining period of the service agreement.

If the contract of a member of the Executive Board is terminated, the disbursement of any remaining variable remuneration components attributable to the period up until the termination of the contract is based on the originally agreed targets and comparison parameters as well as the due dates or holding periods stipulated in the contract.

Upon the premature termination of the Executive Board member’s duties at the company’s request, except in the case of termination for good cause for reasons within the member’s control, the Variable Bonus (depending on entitlement) and the long-term variable remuneration are granted on a prorated basis. If the member of the Executive Board resigns at their own instigation or for good cause for reasons within the respective member’s control, all claims under the long-term variable remuneration will lapse. Claims under the short-term Variable Bonus for the year of resignation will also lapse unless higher target achievement can be clearly demonstrated.

There are no commitments covering the premature termination of the contract of a member of the Executive Board due to a change of control.

For the duration of the post-contractual noncompete agreement of regularly 24 months, the relevant members of the Executive Board are entitled to claim compensation equaling half the most recently agreed annual base remuneration and half their short-term Variable Bonus (subject to the offsetting of any severance payment against the noncompete compensation). The company may waive enforcement of the post-contractual noncompete agreement at any time, however no later than six months before the termination of the contract and, in the event of the contract’s premature termination, also waive this six-month period. In this respect, no compensation may be claimed.

No members stepped down from the Executive Board in 2024.