Remuneration Structure and Elements

a) Overview

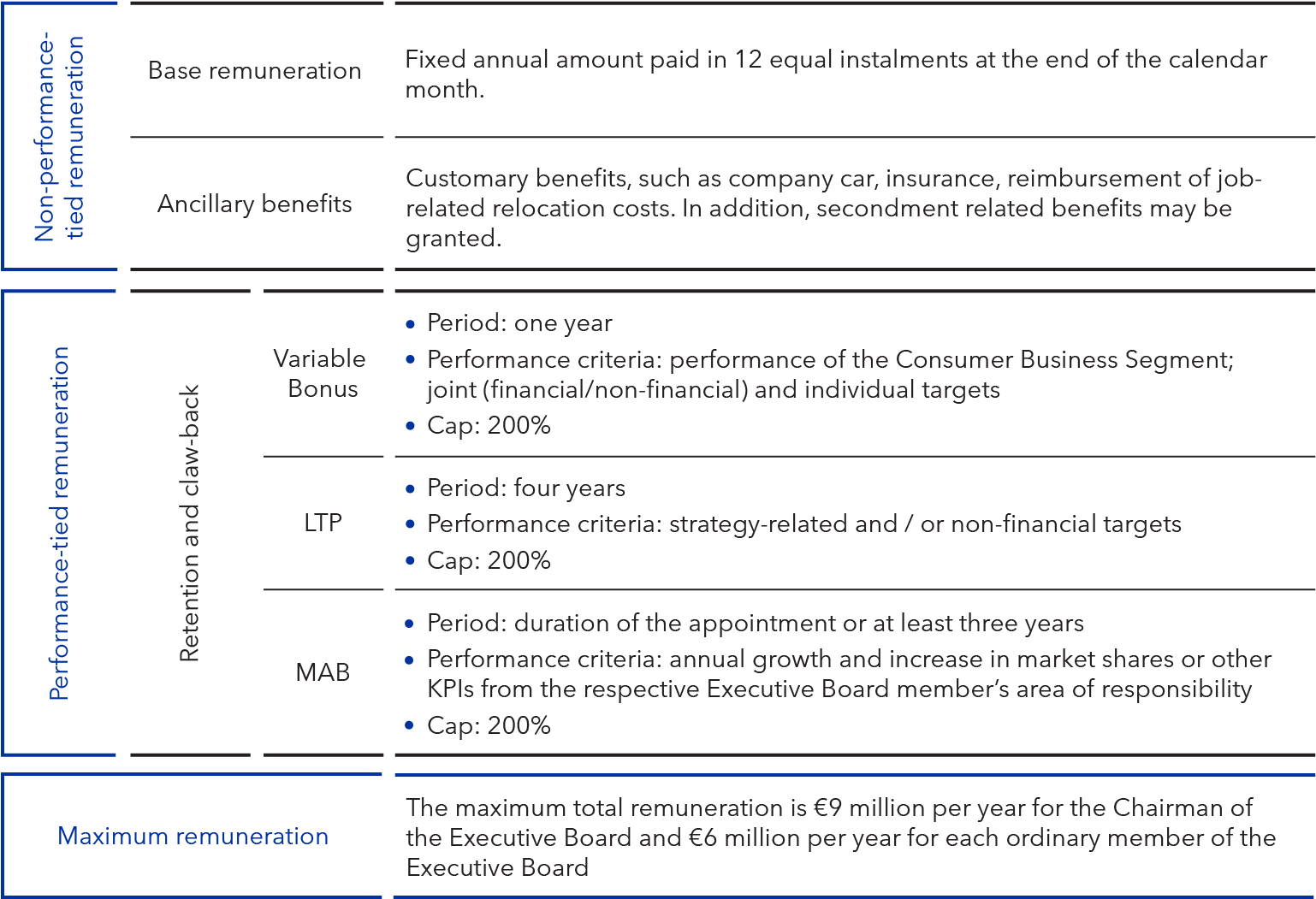

The total remuneration payable to the members of the Executive Board is composed of fixed and variable elements. The fixed remuneration, which is not tied to performance, comprises the base remuneration plus ancillary benefits. The variable remuneration is composed of a short-term variable bonus with annual targets (Variable Bonus) and a long-term variable bonus (LTP). It may also contain a multi-annual bonus (MAB) that is tied primarily to the targets defined for the area of responsibility of that member of the Executive Board. In addition, the members of the Executive Board may be offered a reappointment bonus (may also be tied to performance).

The LTP can be converted into a defined contribution benefit commitment (see g) below). Other than this, there are no pension commitments for the serving members of the Executive Board.

Remuneration components

As a rule, the relative share of the base remuneration, on the one hand, and the short-term and long-term variable remuneration, on the other hand, breaks down as follows (including regular benefits but excluding any secondment-related benefits and reappointment bonuses):

Relative Shares of the Remuneration Components

In this description of the relative shares, long-term variable remuneration components (MAB and LTP) are included with an annual target value on a prorated basis, notwithstanding the fact that they are not due for payment until the end of the period. If a member of the Executive Board is granted a reappointment bonus, this is generally up to 50% of the annual target total remuneration at the beginning of the appointment period. The secondment-related benefits may equal an amount of up to 100% of the base remuneration depending on the location (see c) below for a breakdown of ancillary benefits). The relative shares accounted for by the other remuneration components are modified correspondingly in these cases.

The variable remuneration is predominantly measured over a multi-year period. In addition, the share of variable remuneration from long-term targets exceeds the share from short-term targets.

The remuneration of the individual members of the Executive Board in 2023, including the relative shares of the remuneration components granted and owed (within the meaning of § 162 (1) sentence 2 no. 1 AktG) is reported in the “Remuneration of the individual Executive Board members in 2023” section.

b) Base remuneration

The base remuneration is a fixed annual amount paid in 12 equal installments at the end of each calendar month. If the service agreement begins or ends part way through a fiscal year, the base remuneration for that fiscal year is paid pro rata.

Together with the other remuneration components, the base remuneration forms the basis for recruiting and retaining the highly qualified members required by the Executive Board to develop and implement the business strategy. The remuneration should reflect both the duties and performance of the individual Executive Board members and their skills and experience.

c) Ancillary benefits

Each Executive Board member receives customary non-cash remuneration components and other ancillary benefits. The regular benefits may include:

- Provision of a company car, which may also be used for private purposes. In accordance with the Group’s “Green Car Policy,” the emissions produced by the company car must not exceed a certain carbon threshold. In lieu of a company car, a monthly “cash for car” allowance may also be granted.

- Customary insurance cover, including contributions to health and accident insurance, as well as to any invalidity and surviving dependents policies

- Reimbursement of job-related relocation costs

- Allowance for school expenses

If, at the request of the company, a member of the Executive Board relocates work location or residence or does not maintain them at the headquarters of the company, other benefits may be granted. Such secondment-related benefits may particularly include:

- Foreign-secondment allowance to cover the cost of accommodation at the place of residence

- Cost of flights for the member of the Executive Board and corresponding family to and from the place of residence

- Further health insurance expenses

d) Reappointment

In individual cases, the Supervisory Board may agree on a bonus payable in the event of reappointment. As a rule, this reappointment bonus is due upon the reappointment taking effect (“reappointment bonus”).

The Supervisory Board may at its own due discretion determine the structure of the reappointment bonus, in particular as a performance-related bonus, to which the performance criteria defined for the Variable Bonus (see e) below) or the MAB (see f)) apply.

e) Variable Bonus

The members of the Executive Board receive for each fiscal year a Variable Bonus tied to the performance of the Consumer Business Segment, which is paid out after the Annual General Meeting of the year following the fiscal year in question.

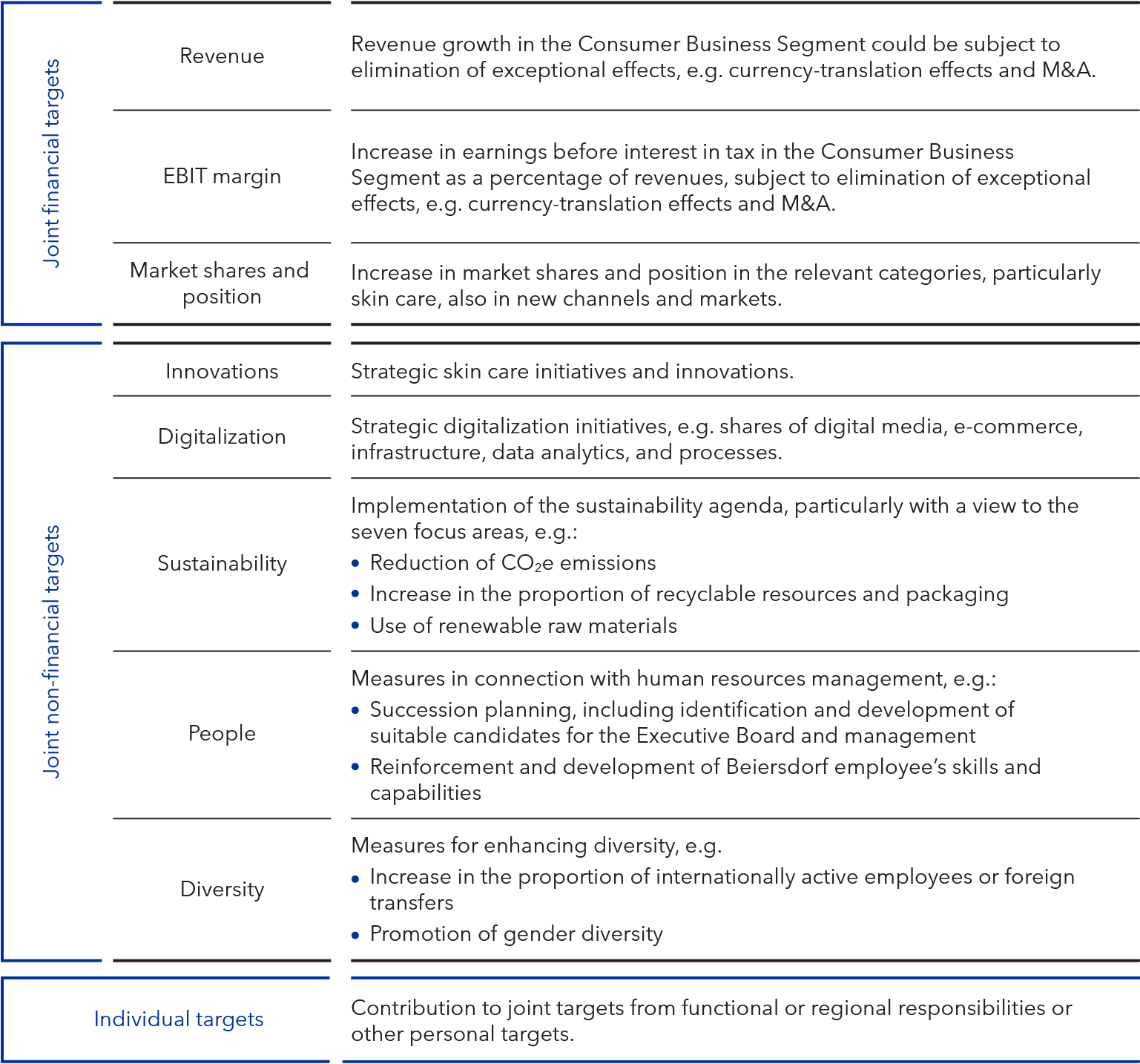

The Variable Bonus is composed of joint and individual performance criteria that are tied to the company’s financial and non-financial performance as well as its strategic and operational development. The joint targets are given a weighting of 70–90% and the individual targets a weighting of 10–30%.

Variable Bonus

The Supervisory Board determines the selection and weighting of the individual performance criteria at the recommendation of the Presiding Committee for the new fiscal year. With respect to the total Variable Bonus, the individual performance criteria for the joint targets generally have a weighting of 10–40% and the individual targets a weighting of 5–20%.

In accordance with the remuneration system, the following performance criteria may be used for the Variable Bonus (at the discretion of the Supervisory Board):

he performance criteria underlying the Variable Bonus create an incentive for the Executive Board to increase the company’s enterprise value on a sustained and long-term basis in line with the C.A.R.E.+ strategy. In particular, sales is to be increased by opening up new growth markets and areas of business, while profitability is to be improved by means of simultaneous investments in innovations. Market shares are to be widened and market positions strengthened by reinforcing the global brands and improving consumer proximity as well as through new digital channels and technologies. The performance criteria defined in the sustainability agenda and those related to diversity also reflect – in line with the Core Values underlying the strategy – the responsibility that the Executive Board has for creating long-term value for people, the environment, and society.

As a general rule, the targets defined for the performance criteria are based on the applicable annual planning. Similarly, measurable criteria are defined for the non-financial targets as far as possible. Depending on the individual case, these may be derived from the annual planning, strategic projects, or other activities. The achievement of non-financial targets is determined by comparing actual with target achievement.

On this basis, the Supervisory Board defines percentage target-achievement levels for the components of the Variable Bonus after the end of the fiscal year. The following target-achievement levels apply:

- The applicable components are omitted if target achievement is less than 70%.

- 50% of the target amount defined for the component in question is granted for target achievement of 70%.

- 80% of the target amount defined for the component in question is granted for target achievement of 80%.

- 200% of the target amount defined for the component in question is granted for target achievement of 200%. A cap is applied to target achievement of above 200%.

- The intermediate values are interpolated on a linear basis.

Target Achievement levels Variable Bonus

Subsequently, the total target achievement for and the amount of the Variable Bonus are calculated on the basis of the target achievement for the individual components.

To allow for extraordinary developments, the Supervisory Board may at its own due discretion raise or lower the Variable Bonus by up to 20%. Additionally, the members of the Executive Board are able to transfer bonus entitlements to the long-term variable remuneration LTP; no use was made of this option in 2023.

For the 2023 Variable Bonus, the Supervisory Board set the joint and individual performance targets shown in the table below and, on February 5, 2024, determined the level of target achievement (also shown below) and resulting payment amount. In view of the end of the measurement period on December 31, 2023, the 2023 Variable Bonus was “granted” to the Executive Board members in fiscal year 2023, even though it is not paid out until after the 2024 Annual General Meeting.

Variable Bonus 2023

Performance criteria |

|

Target level |

|

Actuals 2023 |

|

Weighting |

|

Target achievement |

|||

|---|---|---|---|---|---|---|---|---|---|---|---|

Net sales growth Consumer |

|

5.5% net sales growth (gatekeeper: 12.5% return on sales) |

|

12.6% |

|

24.5% |

|

200.0% |

|||

Skin Care in-market performance |

|

Outperforming relevant skin care market: increase in sell-out above market by +180bps in 2023 |

|

117 bps |

|

24.5% |

|

89.5% |

|||

NIVEA and Derma innovation |

|

Increase in share of net sales of most important innovation projects to 14.5% in 2023 |

|

14.6% |

|

7.0% |

|

112.5% |

|||

|

|

Increase of net sales W630 (NIVEA LUMINOUS 630®; Thiamidol; Lumidose) by 28% (vs. 2022) |

|

49% |

|

|

|||||

Digital transformation |

|

Over proportional growth of e-commerce: increase in ecommerce net sales by 38% (vs. 2022) |

|

22% |

|

7.0% |

|

88.0% |

|||

|

|

Upskilling of digital marketing experts |

|

1,342 employees |

|

|

|||||

|

|

Digital upskilling of employees |

|

9,117 employees |

|

|

|||||

Organizational development & people |

|

Enhance employee engagement in regard to specific topics like “learn and grow”; and “open communication” by 1.0 points on average (gatekeeper: delivery of high quality development plans) |

|

1.0 points |

|

7.0% |

|

100.0% |

|||

Target achievement for joint targets |

|

144.5%1 |

|||||||||

|

|||||||||||

|

|

Performance criteria |

|

Weighting |

|

Target achievement |

|---|---|---|---|---|---|---|

Vincent Warnery |

|

CEO: Development Skin Care business; S4/HANA implementation; set up of new Beiersdorf HQ |

|

30.0% |

|

165.0% |

Oswald Barckhahn |

|

Europe/North America: Net sales growth; outperforming relevant Skin Care market, derived from market share; results of employee survey and employee development |

|

30.0% |

|

131.3% |

Astrid Hermann |

|

Finance: S4/HANA implementation; finance and IT functional organization and efficiency |

|

30.0% |

|

160.4% |

Nicola D. Lafrentz |

|

HR: Succession planning and development, set-up and move to new Beiersdorf Campus, development of HR organization, with focus on diversity |

|

30.0% |

|

141.7% |

Grita Loebsack |

|

NIVEA: Bigger and better innovations, delivery of sustainability targets, accelerate digital marketing, team development and increase diversity |

|

30.0% |

|

131.3% |

Ramon A. Mirt |

|

Emerging Markets: Net sales growth; outperforming relevant skin care market, derived from market share; new markets; development of lead team, including women in leadership |

|

30.0% |

|

139.2% |

Patrick Rasquinet |

|

Pharmacy & Selective: Development of Derma and Chantecaille business; leadership development |

|

30.0% |

|

80.0% |

|

|

Target remuneration Variable Bonus (in € thousand) |

|

Overall target achievement |

|

Payment amount (in € thousand) |

|---|---|---|---|---|---|---|

Vincent Warnery |

|

1,000 |

|

150.7% |

|

1,507 |

Oswald Barckhahn |

|

300 |

|

140.6% |

|

422 |

Astrid Hermann |

|

300 |

|

149.3% |

|

448 |

Nicola D. Lafrentz |

|

300 |

|

143.7% |

|

431 |

Grita Loebsack |

|

300 |

|

140.6% |

|

422 |

Ramon A. Mirt |

|

300 |

|

142.9% |

|

429 |

Patrick Rasquinet |

|

300 |

|

117.2% |

|

352 |

f) Multi-annual bonus (MAB)

Under the currently still applicable remuneration system, the long-term variable remuneration for the members of the Executive Board may additionally include a multi-annual bonus (“MAB”). The MAB particularly has the strategic purpose of strengthening Beiersdorf in regional growth markets or specific business areas.

The performance criteria for the MAB are derived from the targets defined for the areas of responsibility assigned to the members of the Executive Board. In particular, target achievement may be measured on the basis of growth according to annual or multi-annual corporate planning and by reference to the growth in market shares in the applicable region or business area during the appointment of the relevant member of the Executive Board or over a period of at least three years.

Multi-annual bonus

Percentage target achievement is also measured in accordance with the arrangements for the Variable Bonus (see description for target achievement levels for Variable Bonus in e) above). To allow for any extraordinary developments, the Supervisory Board may at its own due discretion raise or lower the MAB by up to 20%.

Of the serving Executive Board members, only Ramon A. Mirt was offered an MAB in 2023 (target amount: €500 thousand p.a.) for his activities in Group companies. This MAB relates to a measurement period from January 1, 2019, to December 31, 2024, and is calculated based among other things on the average annual growth rate in accordance with corporate planning in the regions for which Ramon A. Mirt is responsible and on the increase in market shares throughout his term of office as a member of the Executive Board. After the end of the term of this MAB for Ramon A. Mirt, no further MAB will be granted to any member of the Executive Board.

g) Long-term bonus (LTP)

LTP 2021–2024

Executive Board members receive a multi-annual bonus measured on the basis of the targets for the achievement of strategic criteria after the expiry of a four-year bonus period from 2021 through 2024 (LTP 2021–2024). For Executive Board members appointed during the current LTP 2021–2024 bonus period, a prorated bonus period up to the end of 2024 applies. The LTP 2021–2024 is due for payment to the serving members of the Executive Board after the 2025 Annual General Meeting; the LTP 2021–2024 for serving members of the Executive Board is therefore not “granted and owed” in 2023 within the meaning of § 162 (1) AktG.

Long-term bonus (LTP)

The LTP 2021–2024 makes a material contribution to advancing the company’s C.A.R.E.+ strategy by giving the Executive Board an incentive for securing sustainable and profitable growth particularly by strengthening the focus on skin care, sustainability, digitalization, opening up new growth markets and business areas, innovations, and human resource development.

Joint targets for all members of the Executive Board apply to the LTP 2021–2024 and are tied to the company’s strategic development. They can be weighted individually depending on the duties involved. For this purpose, the Supervisory Board defines measurable non-financial or financial criteria, which are primarily derived from the implementation of the C.A.R.E.+ strategy and the multi-annual planning required to be submitted to the Supervisory Board for approval.

On the recommendation of its Presiding Committee, the Supervisory Board has set the following performance criteria and weightings for the LTP 2021–2024:

Strategic targets |

|

Target level (100% target achievement) |

|

Weighting |

|---|---|---|---|---|

Digital Transformation |

|

Increase in e-commerce sales by 95% (vs. 2021) up to 2024, the successful go-live of S4/HANA, increase of digital 1-on-1 consumer connections |

|

20% |

Win with Skin Care |

|

Positioning as a leading skin care company through the implementation of a new innovation management process and by increasing the innovation share to 10% (of net sales) |

|

20% |

Opening up new growth markets and areas of business |

|

Accelerate sales growth in the USA, China and the Emerging Markets through enlarged presence and the delivery of business plans |

|

20% |

Sustainability |

|

Reduction of global Scope 1, 2 & 3 emissions by 20% (vs. 2018) and increasing the share of recycled materials in plastic packaging by 20%, each by 2024 |

|

20% |

Diversity and employee development |

|

Increasing the proportion of women at management levels MG 1–4 to 45% and succession planning for MG 1–4, including increase in internal and international promotions |

|

20% |

|

|

|

|

|

Performance metrics (applicable if strategic targets ≥ 90%) |

|

|

||

Value Above Market |

|

Outperforming relevant skincare market (market share, measured as net value creation, adjusted for portfolio mix effects) |

|

50% |

Net Sales |

|

Net sales above market (nominal) from 2021–2024 (gatekeeper: EBIT target p.a. of the annual business plan +/–10%) |

|

50% |

After the expiry of the bonus period, the Supervisory Board defines the percentage target achievement levels between 0 and 200% for the strategic targets of the LTP 2021–2024. At or above an overall target achievement of 90%, target achievement for the aforementioned strategic targets is weighted with the target achievement for the performance metrics (if target achievement ≥ 100%) from the multi-year planning adopted in 2021. Nominal sales growth exceeding the market (with an EBIT gatekeeper of +/–10% deviation from plan) accounts for half of these performance criteria. Outperformance of the relevant skin care market (based on market shares and measured as net value added, excluding market growth and portfolio mix effects) in the Consumer categories accounts for the other half. In addition, the Supervisory Board may at its own due discretion raise or lower the target achievement for the LTP and the resultant bonus by up to 20% for objective reasons, for example in response to extraordinary developments.

The members of the Executive Board also have the option, effective expiry of the bonus period in 2024, of converting all or part of the LTP into a pension commitment in the form of a defined contribution commitment for which a reinsurance policy can be concluded.

LTP Enterprise Value Component under the old remuneration system

As per their contracts, the serving Executive Board members appointed prior to 2021 received a share in the increase in enterprise value for the Consumer Business Segment in the form of a multi-annual bonus (LTP Enterprise Value Component), which was based on a mathematical formula drawn from the annual financial statements at the beginning and end of their terms of office, provided it had not already been settled. The Supervisory Board has agreed on rules in this respect to prevent inappropriately high remuneration as a result of the LTP Enterprise Value Component and the LTP 2021–2024.

Under the LTP Enterprise Value Component, Executive Board members are allocated a notional share of the enterprise value (Base Virtual Units, BVU) at the start of their period of appointment or reappointment. The Executive Board member will be paid their share of the percentage increase in the LTP Enterprise Value Component once their period of appointment or reappointment has ended and following, where applicable, an additional vesting period (“bonus period”), if the Annual General Meeting approves the Executive Board member’s actions. The increase in enterprise value corresponds to the percentage share of the Executive Board member’s (notionally allocated) Enterprise Value Component that will be paid to them. For the Executive Board members appointed before 2017, the enterprise value is calculated as a multiple of sales and EBIT as reported in the consolidated financial statements. The increase in value is the increase in enterprise value from the beginning to the end of the bonus period. In each case, this is calculated as an average over three years. For Executive Board members appointed from 2017 onward, the increase in enterprise value is calculated from the increase in sales from the beginning to the end of the bonus period, unless EBIT deviates by more than 10% from plan.

As with the Variable Bonus, sales are adjusted for special factors. If applicable, EBIT is adjusted for, among other things, any deviations from the plan for marketing expenses as well as expenses for research and development compared with the start of the bonus period. In individual cases, the Supervisory Board is also entitled to make adjustments following due assessment of the circumstances, for instance by adjusting for special factors and inflation or by increasing or decreasing the LTP Enterprise Value Component for objective reasons by up to 20%.

With the LTP Enterprise Value Component, the Executive Board members can also share in the enterprise’s performance by making a personal investment and acquiring Covered Virtual Units (CVU). These are acquired by retaining bonus payments due under the Variable Bonus, by the Executive Board member providing collateral (e.g., by pledging a suitable asset), or by way of annual allotment (Bonus CVUs). The Covered Virtual Units generally participate in positive and negative percentage changes in the value of the Enterprise Value Component; however, the Bonus CVUs only participate in positive changes. They vest immediately and are paid out in full or in part, or not paid out, after being adjusted on the basis of the enterprise value performance. For Covered Virtual Units, the Executive Board member may receive a further Enterprise Value Component in the same amount (Matching Virtual Units, MVU), corresponding to the Base Virtual Units.

As a rule, the LTP Enterprise Value Component is limited to a maximum amount for each member of the Executive Board (200% cap, corresponding to around 10% p.a.). This does not apply to Covered Virtual Units acquired through personal investment, since the Executive Board member is also exposed to a risk of loss in this case. If an Executive Board member is active for a period shorter than the respective member’s period of appointment, the LTP Enterprise Value Component is reduced pro rata. The LTP Enterprise Value Component is forfeited in the event that an Executive Board member’s contract is terminated prematurely at the request of the Executive Board member or by the company for good cause.

For the serving Executive Board members in 2023, the bonus period for the offered LTP Enterprise Value Component is still ongoing only for Ramon A. Mirt.

Capping of the variable remuneration and maximum remuneration

The amount of all variable remuneration elements (Variable Bonus, LTP, and MAB, if granted) is capped at 200% of the applicable individual target amount. The amount of the maximum total remuneration is determined on the basis of this relative cap taking into account all fixed and other remuneration components that may be granted to a member of the Executive Board depending on the individual case.

The maximum remuneration is €9 million per year for the Chairman of the Executive Board and €6 million per year for each ordinary member of the Executive Board. This maximum remuneration contains the amounts of the long-term variable remuneration (MAB and LTP) with an annual maximum value (200%) on a prorated basis, notwithstanding the fact that they are not due for payment until the end of the period. In principle, it is not possible to report on adherence to maximum remuneration within the meaning of § 162 (1) sentence 2 no. 7 AktG until after the long-term variable remuneration has been paid out. Nevertheless, the remuneration granted and owed to the individual Executive Board members in the reporting year is compared against the maximum remuneration, even when the long-term variable remuneration has not been paid out in the individual case (see the tables in the following section “Remuneration of the individual Executive Board members in 2023”).

Retention and claw-back arrangements

The Supervisory Board has the possibility of reducing or retaining at its own due discretion the variable remuneration by up to 20% to appropriately take account of exceptional circumstances.

Under the applicable remuneration system, variable remuneration components that have already been determined or paid may be retained or claimed back by the Supervisory Board if the basis for calculating the original target achievement, particularly the applicable consolidated financial statements, subsequently proves to be materially incorrect due to new facts or evidence (“claw-back”). However, this possibility is barred no later than three years after payment. This does not prejudice any other remedies that the company may have to recover damages from the member of the Executive Board, particularly under § 93 (2) AktG. The Supervisory Board did not make use of this possibility in 2023.

Rules in relation to termination of Executive Board members’ duties

In the event of the premature termination of the office or activities of a member of the Executive Board for reasons beyond that member’s control, the Executive Board service agreements provide for a cap on the termination benefits or other payments of twice the value of the base remuneration and twice the value of the Variable Bonus and any MAB or a cap equaling the total target remuneration for the remaining period of the service agreement.

If the contract of a member of the Executive Board is terminated, the disbursement of any remaining variable remuneration components attributable to the period up until the termination of the contract is based on the originally agreed targets and comparison parameters as well as the due dates or holding periods stipulated in the contract.

Upon the premature termination of the Executive Board member’s duties at the company’s request, except in the case of termination for good cause for reasons within the member’s control, the Variable Bonus (depending on entitlement) and the long-term variable remuneration are granted on a prorated basis. If the member of the Executive Board resigns at his or her own instigation or for good cause for reasons within the respective member’s control, all claims under the long-term variable remuneration will lapse. Claims under the short-term Variable Bonus for the year of resignation will also lapse unless higher target achievement can be clearly demonstrated.

There are no commitments covering the premature termination of the contract of a member of the Executive Board due to a change of control.

For the duration of the post-contractual noncompete agreement of regularly 24 months, the relevant members of the Executive Board are entitled to claim compensation equaling half the most recently agreed annual base remuneration and half their short-term Variable Bonus. The company may waive enforcement of the post-contractual noncompete agreement at any time, however no later than six months before the termination of the contract and, in the event of the contract’s premature termination, also waive this six-month period. In this respect, no compensation may be claimed.

The 2022 Remuneration Report reported on the specific arrangements in connection with the termination of the Executive Board membership of Thomas Ingelfinger and Zhengrong Liu in fiscal year 2022. No members stepped down from the Executive Board in 2023.